3 mins read//

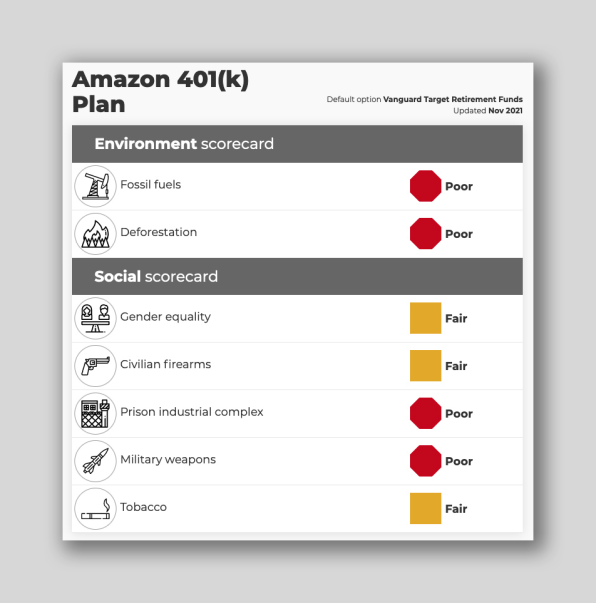

When employees pay into their 401(k) plans, they may not realize that they’re inadvertently contributing to more than their secure futures: They’re also contributing to climate change, the private prisons industry, and the manufacturing of military weapons.

As You Sow, a shareholder advocacy nonprofit, raises awareness among the public about this irony, primarily using a suite of online tools to help people find out what their companies are investing their earnings in. It’s especially important when that doesn’t align with citizens’ increasing concerns about social and environmental causes. The organization hopes it can “trigger an emotional response” to get them to effect change in company policies. “People simply don’t know that their money is being invested in companies that are destroying their future,” says CEO Andrew Behar.

When employees contribute to retirement plans, by default, they typically send much of their money into one of either Vanguard’s Target Retirement Income Fund, or Blackrock’s LifePath Funds. Those plans automatically invest your money into index funds, basically a “bucket of companies” that includes ones concerned with the burning of fossil fuels, deforestation, and private prison or border operations.

As You Sow has methodically researched 16 of America’s biggest employers, including Amazon, Disney, Microsoft, and Visa, finding that trend to be true across the board. According to the organization’s latest data, which it updates monthly, 55% of plan assets at Netflix are invested in the Vanguard option at the time of writing, which currently invests between 5% and

7.5% into fossil fuels. In total, according to As You Sow’s methodology, Netflix employees are investing about $58 million dollars every year into fossil fuels, $16 million in military arms, and $5 million into deforestation. This practice often goes against companies’ outward branding. “Why is it that we present ourselves as these climate heroes, and yet all of our employees own companies burning down the Amazon?” Behar says. As You Sow’s Corporate Retirement Plan Sustainability Scorecard—winner of the impact investing category of Fast Company’s 2022 World Changing Ideas Awards—raises awareness about detrimental 401(k) investments, and provides a toolkit to help employees force change.

Some companies do offer sustainable plans as alternatives, such as Disney. But only 0.04% of plan assets at The Walt Disney Company are enrolled in those options. In most other cases, employees have to use a “self-directed option,” taking on the onus to handpick individual funds of their liking. “That is such an additional ask of people,” says Andrew Montes, As You Sow’s director of digital strategies.

The organization wants employers to communicate the options more clearly to staff. Better still, make it so that “sustainability is baked in as the standard,” Montes says. They could also do more to combat the “stubborn, pernicious myth” that sustainable investment means lower financial returns. As companies are gradually doing more to combat climate change, it’s likely that it’s oil and gas that will become the unsustainable business models of the future.

Where possible, As You Sow aims to show people how to advocate for changes at their workplaces. The website’s Action Center details how to approach a company’s plan administrator, making available workable email templates; better still, it advises how to form a coalition with coworkers, and work together to approach those in charge. “Now, you can have a community that can actually maybe make some noise and get some stuff done,” Montes says. They will need to persevere, and keep putting on pressure, because, unlike institutional investors, 401(k) plan administrators are not concerned with maximizing the dollars in the pot. Rather: “[They’re] trying to minimize the amount of complaints [they] get.”

As You Sow is hoping to add more companies to its list every month—and to launch an assessment tool for the Thrift Savings Plan, the plan offered to federal employees. As a clear example of the discrepancy between people’s values and the reality, Montes mentions a friend who works for the government at the U.S. National Arboretum. By day, she “plays with all these cool plants and keeps them alive,” he says—and then, has no choice but to place her dollars into the pockets of oil giants like Exxon and Chevron.