What is ESG?

The use of environmental, social, and governance factors to inform investment decisions.

Introduction

From consumers to policymakers, many economic actors are backing sustainability—creating a powerful portfolio opportunity. In just a few years, ESG investing has grown in prominence. How can investors capitalize on this trend?

69% of retail investors are interested in ESG. Yet only 10% actually invest in products that incorporate ESG factors (Source: CFA Institute | June 18, 2020)

To properly invest in ESG, it's important to first fully understand it. Here are seven essential reasons that help investors understand the growing importance of ESG investing.

The 7 Essentials

1) ESG considerations are affecting consumer preferences and public attitudes.

“I buy from companies that are conscious of protecting the environment.”

Why it matters

Consumers are making decisions with sustainability in mind, and they’re voting with their wallets. This change has ripple effects, and is expanding from the individual to the macro level.

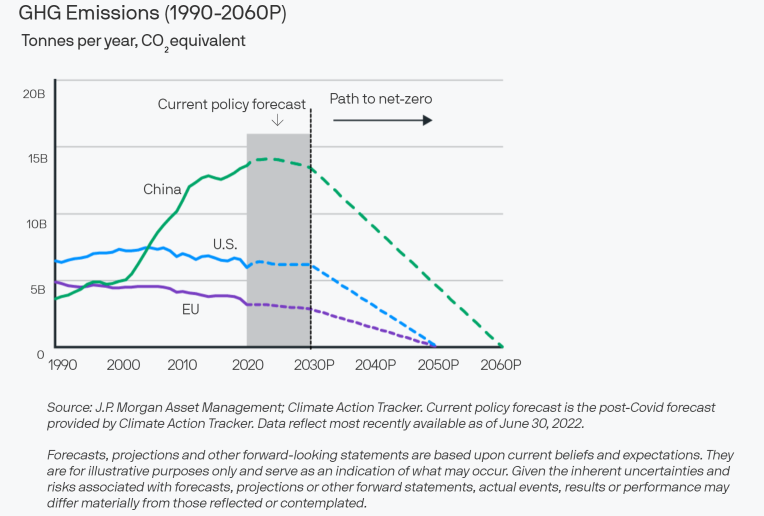

2) Policymakers are setting environmental and social goals.

Governments of the world’s top greenhouse gas (GHG) emitters are working towards a net zero future, in which emissions are reduced or offset.

Why it matters

Altogether, over 80 countries — representing 75% of global GHG emissions— have set ambitious net zero emissions targets for the coming decades.

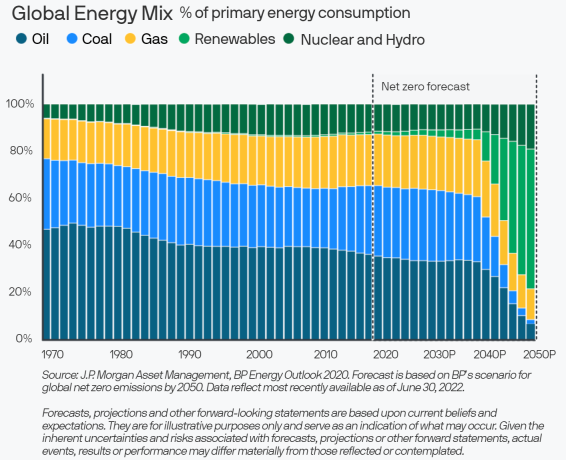

3) For some, the shift to sustainability may be a headwind.

To achieve net zero emissions by 2050, traditional energy needs to account for a much smaller proportion of the global energy mix.

Why it matters

The shift to renewable energy may pose a challenge for industries reliant on fossil fuels. Fortunately, it's not too late for companies to transition.

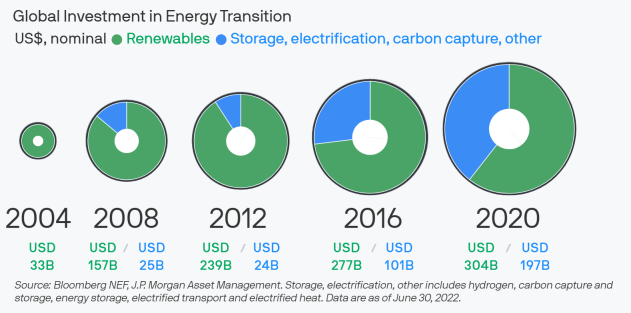

4) ESG creates significant opportunities for those at the forefront of change.

Billions of dollars are flowing into the energy transition.

Why it matters

Sustainability is propelling investment opportunities with return potential.

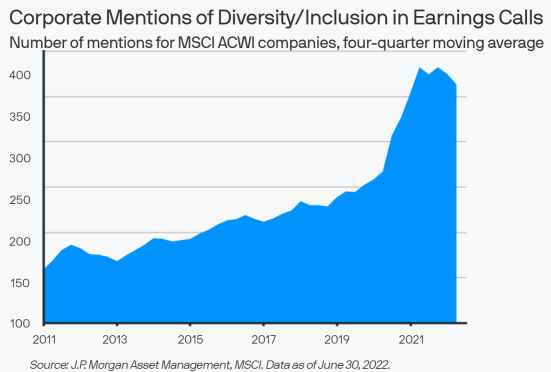

5) ESG covers more than climate—the focus on Social and Governance is growing too.

Why it matters

The recent jump in corporate mentions of social issues signals rising interest and regulatory pressure.

6) ESG is affecting the investment landscape.

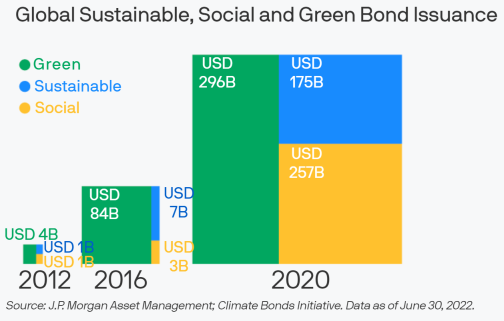

The demand for sustainable fixed income strategies is also growing rapidly, with sustainable bond issuance doubling in 2020.

Why it matters

Sustainable investing is not limited to equities— environmental and social projects have increasing access to financing.

7) ESG is changing the nature of investment flows.

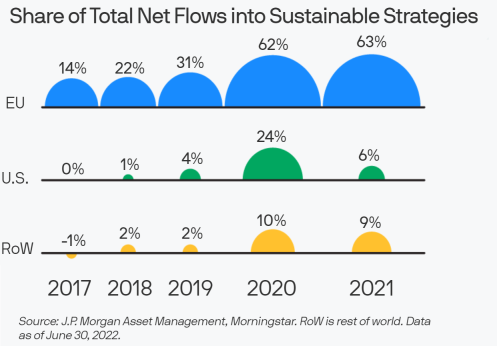

Why it matters

We expect the demand for sustainable funds will continue to increase.

Incorporating ESG criteria into investing is as much about doing well, as it is about doing good.